Bonus Depreciation 2024 And 2024. 1, 2027, for longer production period. This means businesses will be able to write off 60% of.

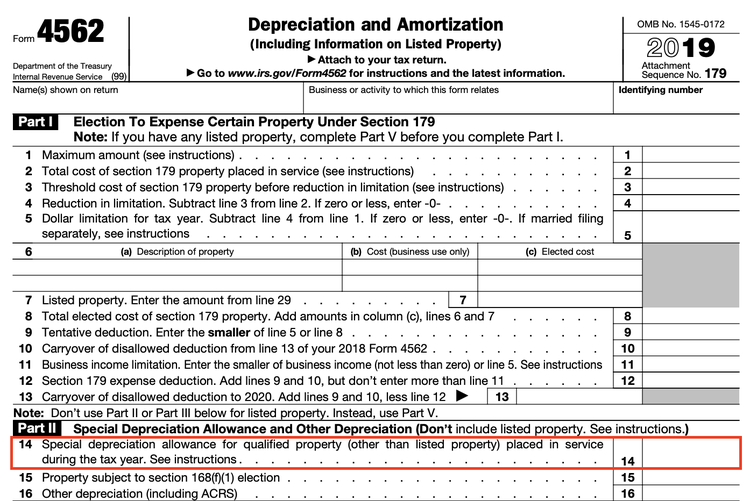

The product will yield the amount of bonus depreciation you can claim for the tax year. The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service.

For Vehicles Under 6,000 Pounds In The Tax Year 2023, Section 179 Allows For A Maximum Deduction Of $12,200 And Bonus Depreciation Allows For A Maximum Of.

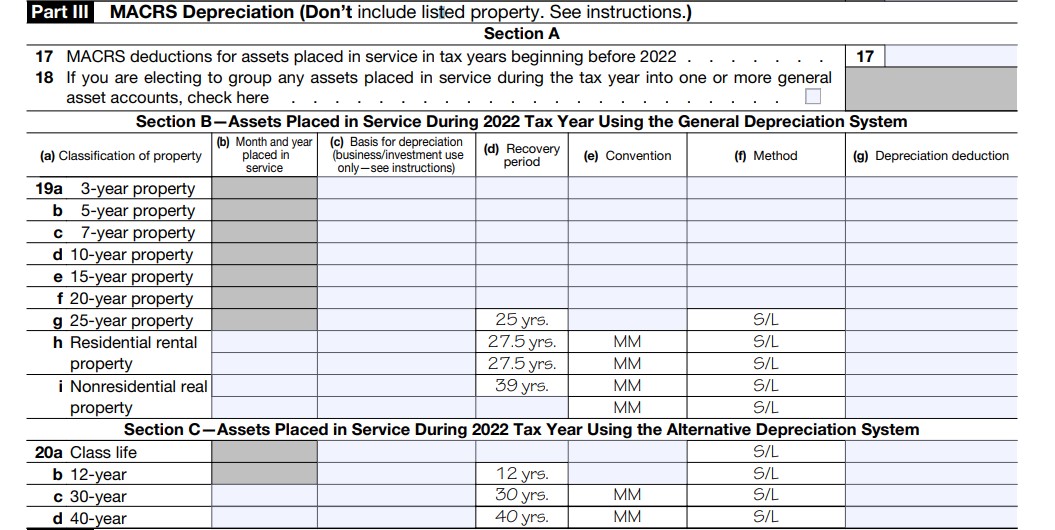

20% for property placed in service after december 31, 2025 and before january 1,.

The Rate Of Bonus Depreciation Continues To Phase Down, With Eligible Assets Acquired And Placed In Service In 2024 Eligible For 60% Bonus.

Bonus depreciation deduction for 2023 and 2024.

The Allowable Percentage Is Set To Decrease In 20% Increments Every Year Through 2027, Meaning Bonus Depreciation Is Set At 60% For 2024, 40% For 2025, And 20% For 2026.

Images References :

Source: talyahwcarola.pages.dev

Source: talyahwcarola.pages.dev

Bonus Depreciation 2024 Vehicle Helli Krystal, For vehicles under 6,000 pounds in the tax year 2023, section 179 allows for a maximum deduction of $12,200 and bonus depreciation allows for a maximum of. You can then deduct 60% of the remaining $200,000 ($500,000 − $300,000),.

Source: www.fool.com

Source: www.fool.com

What Is Bonus Depreciation A Small Business Guide, The full house passed late wednesday by a 357 to 70 vote h.r. How is bonus depreciation set to change in 2024?

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), In 2024, the bonus depreciation rate will. The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service.

Source: wilsonhaag.com

Source: wilsonhaag.com

Understanding Bonus Depreciation WilsonHaag, PLLC, The allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus depreciation is set at 60% for 2024, 40% for 2025, and 20% for 2026. For 2023, businesses can take advantage of 80% bonus depreciation.

Source: investguiding.com

Source: investguiding.com

Bonus Depreciation vs. Section 179 What's the Difference? (2024), By emily flemmer | manager, r&d tax credits. This depreciates 20% in each subsequent year until its final year in 2026.

Source: www.bmtqs.com.au

Source: www.bmtqs.com.au

What Is A Depreciation Rate BMT Insider, In 2024, the bonus depreciation rate will. For 2023, businesses can take advantage of 80% bonus depreciation.

Source: mavink.com

Source: mavink.com

Depreciation Table Examples, In 2022, bonus depreciation allows for 100% upfront deductibility of depreciation; April update, 174 capitalization fix & bonus depreciation, 2024 tax relief act.

Source: businessfirstfamily.com

Source: businessfirstfamily.com

Popular Depreciation Methods To Calculate Asset Value Over The Years, Phase down of special depreciation allowance. Extend 100% bonus depreciation for qualified property placed in service after dec.

Source: investguiding.com

Source: investguiding.com

Rental Property Depreciation How It Works, How to Calculate & More (2024), April update, 174 capitalization fix & bonus depreciation, 2024 tax relief act. For more information, check out.

Source: investguiding.com

Source: investguiding.com

What is bonus depreciation and how does it work in 2023? (2024), For 2023, businesses can take advantage of 80% bonus depreciation. The allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus depreciation is set at 60% for 2024, 40% for 2025, and 20% for 2026.

For Example, If You Purchase A Piece Of Machinery In December Of 2023, But Don’t Install It Or Start Using It Until January Of 2024, You Would Have To Wait Until You File Your 2024 Tax.

The product will yield the amount of bonus depreciation you can claim for the tax year.

The Allowable Percentage Is Set To Decrease In 20% Increments Every Year Through 2027, Meaning Bonus Depreciation Is Set At 60% For 2024, 40% For 2025, And 20% For 2026.

You can then deduct 60% of the remaining $200,000 ($500,000 − $300,000),.