Catch Up Contribution Ira 2024. Blueprint is an independent publisher and. For 2024, that limit goes up by $500 for a total of $8,000.

For an ira, you’re able to contribute an extra $1,000 each year as of 2024, which means you can contribute a total of $8,000 per. So if you have an hsa and you’re 55 or older by the end of the year, you can add another $1,000 to your account.

So The Maximum Total Contribution For 2023 Is $7,500.

Blueprint is an independent publisher and.

For An Ira, You’re Able To Contribute An Extra $1,000 Each Year As Of 2024, Which Means You Can Contribute A Total Of $8,000 Per Year After Age 50 ($7,000.

For an ira, you’re able to contribute an extra $1,000 each year as of 2024, which means you can contribute a total of $8,000 per.

Starting In 2024, The Secure 2.0 Act Also Requires All.

Images References :

Source: rositawcarena.pages.dev

Source: rositawcarena.pages.dev

457 Catch Up For 2024 Gaby Pansie, For an ira, you’re able to contribute an extra $1,000 each year as of 2024, which means you can contribute a total of $8,000 per year after age 50 ($7,000. That's up from the 2023 limit of $15,500.

Source: sandboxfp.com

Source: sandboxfp.com

2023 Contribution Limits for Retirement Plans — Sandbox Financial Partners, The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. Ira contribution limits for 2024.

Source: chelsiewcarina.pages.dev

Source: chelsiewcarina.pages.dev

2024 Ira Limits Over 50 Cori Joeann, Starting in 2024, the secure 2.0 act also requires all. For an ira, you’re able to contribute an extra $1,000 each year as of 2024, which means you can contribute a total of $8,000 per year after age 50 ($7,000.

Source: medcombenefits.com

Source: medcombenefits.com

IRS Announces 2023 HSA Limits Blog Benefits, Starting in 2024, if you earn more. For an ira, you’re able to contribute an extra $1,000 each year as of 2024, which means you can contribute a total of $8,000 per year after age 50 ($7,000.

Source: www.elementforex.com

Source: www.elementforex.com

IRA Contribution Limits And Limits For 2023 And 2024 Forex, Starting in 2024, that limit will be indexed to inflation, meaning it could. Starting in 2024, if you earn more.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, Starting in 2024, that limit will be indexed to inflation, meaning it could. So if you have an hsa and you’re 55 or older by the end of the year, you can add another $1,000 to your account.

Source: choosegoldira.com

Source: choosegoldira.com

401k 2022 contribution limit chart Choosing Your Gold IRA, For an ira, you’re able to contribute an extra $1,000 each year as of 2024, which means you can contribute a total of $8,000 per. Starting in 2024, that limit will be indexed to inflation, meaning it could.

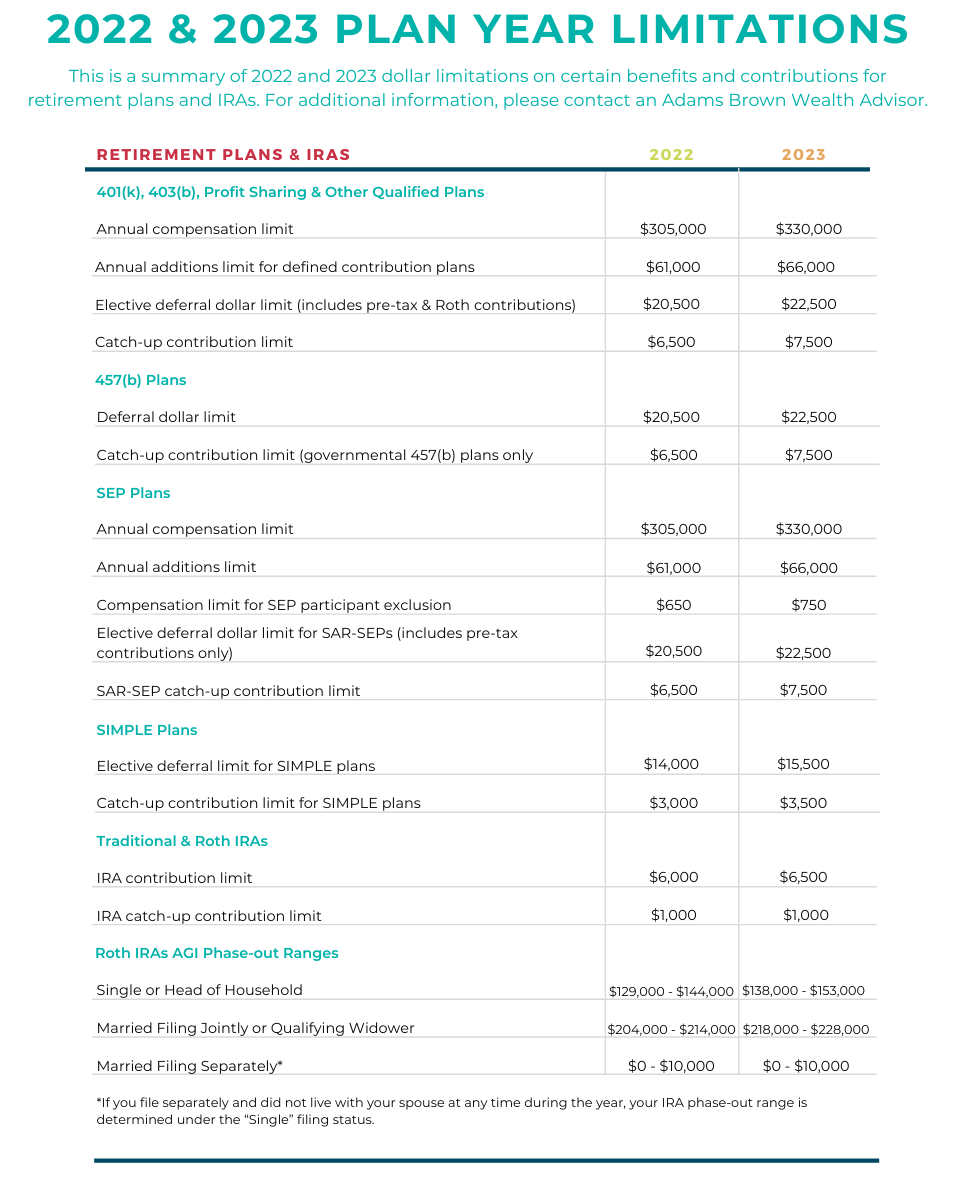

Source: www.adamsbrowncpa.com

Source: www.adamsbrowncpa.com

2023 Plan Contribution Limits Catch Up Contributions Wichita (KS), Starting in 2024, that limit will be indexed to inflation, meaning it could. Starting in 2024, if you earn more.

Source: ee2022d.blogspot.com

Source: ee2022d.blogspot.com

2022 Ira Contribution Limits Over 50 EE2022, For an ira, you’re able to contribute an extra $1,000 each year as of 2024, which means you can contribute a total of $8,000 per. Blueprint is an independent publisher and.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), The 2024 simple ira contribution limit for employees is $16,000. For an ira, you’re able to contribute an extra $1,000 each year as of 2024, which means you can contribute a total of $8,000 per.

The 2024 Simple Ira Contribution Limit For Employees Is $16,000.

For an ira, you’re able to contribute an extra $1,000 each year as of 2024, which means you can contribute a total of $8,000 per.

Starting In 2024, The Secure 2.0 Act Also Requires All.

So if you have an hsa and you’re 55 or older by the end of the year, you can add another $1,000 to your account.